Miami’s Wynwood may be the hottest, hippest neighborhood in America’s hottest city: A dynamic urban fusion of repurposed industrial buildings and warehouses interspersed with new, low-rise buildings housing shops, bars and restaurants, offices and apartments, all of it steeped in artful design and curated graffiti murals.

Its success is no accident. The reinvigorated Wynwood, once a derelict industrial zone, is the deliberate result of unique planning guidelines and development limits painstakingly laid out a decade ago by district property owners and city of Miami planners. The special Wynwood regulations are backed by a distinct vision — for a dense yet human-scaled alternative to the new high-rise forests of Brickell and Edgewater.

But just as they begin to bear fruit, the carefully laid plans for Wynwood are threatened by a controversial new state law, the Live Local Act, which overrides local building controls and encourages developers to supersize projects in exchange for setting aside apartments as ostensibly affordable housing. Critics say Live Local is a giveaway to developers and the promised affordable housing is anything but that.

In Wynwood, Live Local looms in the form of a developer’s plan for a 48-story tower — 36 stories taller than the highest building now allowed in the district — atop a massive parking garage that by itself is larger than much of the new construction in the neighborhood. The Wynwood Neighborhood Revitalization District rules, by contrast, have restricted new buildings to 12 stories.

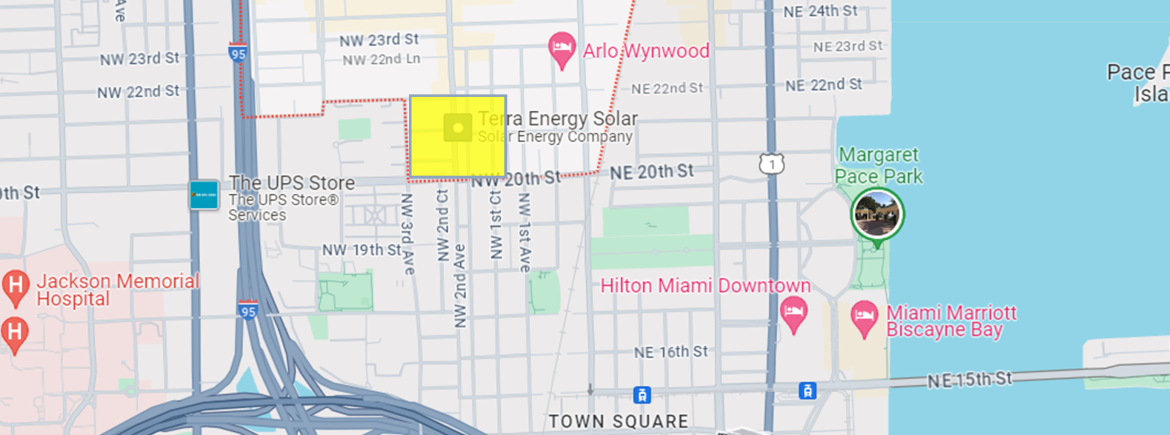

The tower plan, by Bazbaz Development, calls for 544 apartments and even more cars and parking, or 621 spots, at North Miami Avenue and Northwest 21st Street. That would effectively bring a downtown Miami density to narrow Wynwood streets already nearly overwhelmed with traffic and infrastructure that has barely kept up with the current wave of redevelopment.

And the tower project is only the first to surface publicly in Wynwood. City planning officials say five other Wynwood applications have been submitted this year. Records provided to the Miami Herald by the city for three of the proposals call for:

- A 39-story tower with 336 apartments located four blocks north of the Bazbaz project, also on North Miami Avenue, by an affiliate of New York’s Hidrock Properties.

- A 19-story high-rise with 401 apartments located one block west of the Bazbaz site. As part of the project, Miami Court Holdings would preserve and protect an adjacent, two-story Art Deco building as part of the project.

- A 25-story building complex — with 996 apartments and 693 parking spaces located along Northwest Sixth Avenue between 24th Street and 26th Street on the western edge of Wynwood along Interstate 95 — is proposed by property owner David Sedaghati’s Ultimate Equity.

Local stakeholders expect more. They fear Live Local projects will turn the carefully nurtured district into another version of Edgewater, the nearby, rapidly changing, bayfront neighborhood that now consists mostly of towers rising from bulky, street-filling parking pedestals.

“If those controls are now overridden by Tallahassee, which has no idea what Wynwood or any neighborhood is, that’s kind of crazy,” said Juan Mullerat, a Miami planner whose firm, PlusUrbia, wrote the award-winning Wynwood plan, which was adopted as law by Miami city commissioners in 2015. “And it’s a little scary. Come Live Local, and you can just go nuts.”

QUESTIONABLE AFFORDABILITY

As to the promised affordable housing in the Bazbaz tower? Though the specifics haven’t been decided yet, it’s likely to be around 217 apartments, mostly studios, aimed at people making up to 120% of the median household income in Miami-Dade County — the level set by the state’s Live Local legislation. In 2024, under published calculations by the state, that means people making up to $95,400 a year can be charged up to $2,385 per month in rent for a studio. Rent for a one-bedroom would be capped at $2,554.

Live Local — a priority of Florida Senate President Kathleen Passidomo, a Republican from Southwest Florida, and credited to Sen. Alexis Calatayud, a Republican from Miami-Dade County — was billed as the answer to the state’s housing crisis when it was passed in 2023.

It unilaterally lifts zoning restrictions across the state for developers of mixed-use projects that set aside 40% of residential units as workforce housing for 30 years. Housing advocates say local zoning restrictions have often blocked development of affordable dwellings.

It also directs hundreds of millions of dollars in funding and tax breaks to developers who use the law’s provisions to build.

Live Local quickly proved controversial as developers began proposing outscaled projects in municipalities ranging from Doral to Hollywood and Miami Beach. The law’s pre-emption provisions apply in commercial, industrial and mixed-use areas.

At the same time, the Legislature barred local governments from imposing rent controls on private housing and made it harder for municipalities and counties to approve affordable housing in areas zoned residential only.

Some experts say they expect litigation and increased public furor as mammoth Live Local applications proliferate across Miami-Dade.

Source: Miami Herald