Berkadia has secured a $35 million loan to fund the construction of Phase II of Wyncatcher, a new 78,000-square-foot mixed-use creative space in the renowned Wynwood Arts District in Miami.

Managing Director Scott Wadler and Vice President Michael Basinski secured the financing on behalf of the sponsor, Morabito Properties, a Miami-based development firm led by Valerio Morabito.

The deal closed on May 29.

The project consists of two adjoining properties built in phases: Phase I, which was completed in Q4 2023 and consists of 38,400 square feet, is entirely leased to Knotel, a flexible workspace provider. Phase II will consist of 6,000 square feet of ground-floor retail space and 42,000 square feet of creative office space, slated for completion in Q2 2026.

BridgeInvest provided the floating-rate loan which will be used to pay off the existing construction loan on Phase I and fund construction on Phase II.

“Wynwood continues to fortify its reputation as a hub for innovative and creative companies,” said Wadler. “Morabito’s commitment to elegant design fits in perfectly with the ethos of this neighborhood and will ensure Wyncatcher is one of the most desirable creative office properties in the city.”

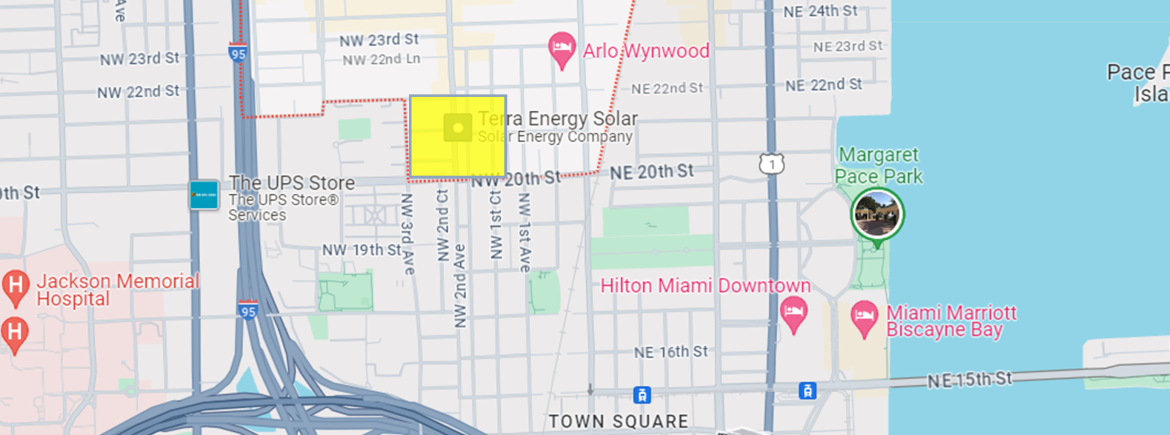

Located at 2143 Northwest 1 Avenue & 2150 Northwest Miami Court, the Wyncatcher is a high-design project by Morabito Properties involving internationally recognized architecture firm Arquitectónica, the trailblazing Vagabongarq team, and Portuguese artist Alexandre Farto, also known as Vhils.

Phase I features a two-story industrial-style building with restaurant space, a rooftop terrace, elegant double-height, black-frame windows, and a Vhils Studio designed carved concrete facade. Phase ll will be composed of an open-air covered car park, a private garden, large double-height white frame windows, high ceilings, and natural light. The space will be ideal for creative tenants with its open-format layout, and with abundant indoor and outdoor areas, will be conducive to hosting of large events and corporate gatherings.

The property affords convenient access to the Wynwood Arts District’s most notable restaurants, retailers, entertainment, and attractions like Wynwood Walls, Pastis, UNKWN, as well as Downtown/Brickell, Miami Beach, and Miami International Airport.