Block Capital Buys Into Diesel Wynwood Project, Plans Relaunch

Bel-Invest unveiled plans for the first Diesel-branded condo building in 2019.

Miami Beach Affordable Housing Project Converting To Boutique Hotel

Construction is expected to cost $22 million.

Clothing Manufacturer/Retailer Moves Headquarters From Midwest To Wynwood

About 45 people work in the 8,200-square-foot office.

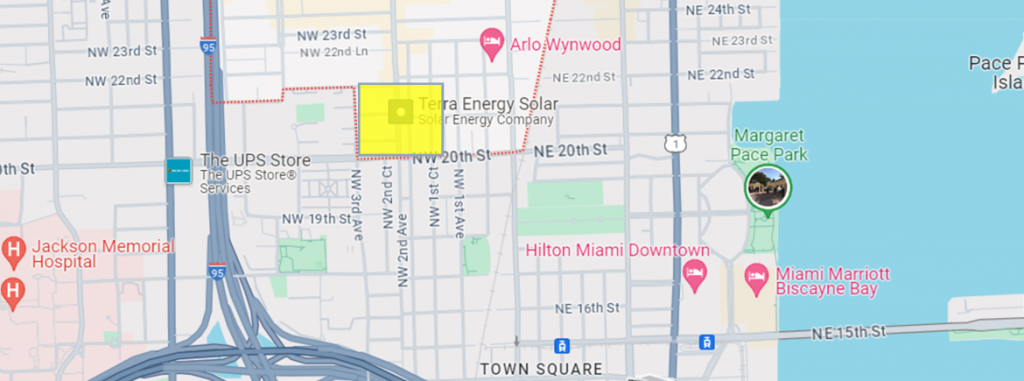

Hidrock And Robert Finvarb Use Live Local Act To Propose 39-Story Rental In Wynwood

According to the proposal, the Arquitectonica-designed project is 21 stories shorter than the maximum height. The 436,934-square-foot development would also house 7,781 square feet of commercial space and 326 parking spots.

Wynwood Office Owner Files For Bankruptcy To Stop Foreclosure

The office building totals 418,337 square feet, with about 200,000 square feet of office space, 25,000 square feet of retail and 490 parking spaces. It was completed on the 1.11-acre site in 2021.

Rilea Group Pays $21M For Wynwood Site To Build 146 Condos

The property last traded for $12.2 million in 2021.

The End Of Wynwood? Massive Projects Would Remake Miami’s Hippest Neighborhood

Some experts say they expect litigation and increased public furor as mammoth Live Local applications proliferate..

Three More Live Local Act Apartment Towers Proposed In Wynwood

The towers, which would range from 18 to 48 stories, promise to alter the look of the Miami neighborhood, where heights for years have been capped at 12 stories.

Developer Scores $77M Loan For 8-Acre Wynwood Assemblage

More Development spent $115M assembling six city blocks. The land could be developed into nearly 2.5 million square feet.

Homes Near Wynwood Could Be Replaced With Apartments

The city’s Urban Development Review Board will consider plans for the half-acre site at 107, 121, and 127 N.W. 31st Street on June 20.

Doug Levine Continues Wynwood Sell-Off, Listing Two Office Floors For $28M

The Crunch Fitness founder and real estate investor recently sold off three other properties nearby.

Hotel Coming To South Beach: Keyah Buys Washington Ave Site For $20M

The Aventura-based firm plans to redevelop two commercial buildings purchased from investor Jimmy Resnick.

Board Slams 48-Story Live Local Act Project Proposed In Wynwood

Under the Live Local Act, the committee’s hands are tied on the project’s height and size in general. But members took issue with various aspects of the tower’s design and its scale.

Large Cold Storage Facility Coming To Allapattah

In August 2022, a Longpoint subsidiary paid $16 million for the development site, a 6-acre former trailer park.

Co-Working Giant Closing Outpost In Miami Beach In Bankruptcy Restructuring

As of last month, firm was still trying to reach an agreement with the landlord

Construction Of Phase 2 Of Wynwood’s ‘Wyncatcher’ Project Set To Begin

Phase II will consist of 6,000 square feet of ground-floor retail space and 42,000 square feet of creative office space, slated for completion in Q2 2026.

Developer Proposes Wynwood’s Tallest Project At 48 Stories

Because the project will be developed under the Live Local Act, state law allows developers to bypass neighborhood’s height restriction of 12 stories.

ABH Developer Group Breaks Ground On Two More Projects In Miami’s Wynwood Norte District

The Wynwood Norte district is bordered by I-95 to the west and North Miami Avenue to the east, and Northwest 29th Street to the south and I-195 to the north. Given its walkability to many art, cultural and entertainment and dining destinations along with its recent zoning overhaul, the neighborhood is poised for significant development.

Pharma Company Moves HQ From Midwest To Miami Beach

Previously based in Sioux Falls, South Dakota, the company has set up shop at 777 W 41st St. that opened in April.

i5 Wynwood Co-Living Community Reaches Completion With 215 Suites

Residents will have their own private bedroom and ensuite bathroom, inside a 3 or 4 bedroom apartment. The living area and kitchen will be shared.

Construction Progress At Wynhouse Miami

Construction on the 8-story building began last summer. Substantial completion is expected in January 2025.

Wynwood Arcade Being Redesigned As Wynwood Jungle

The latest design received unanimous support from the committee, recommending approval with a few conditions.

94-Year-Old South Beach Hotel Targeted In Foreclosure

Stormfield Capital Funding I LLC filed a foreclosure action against Mark McClure, the loan guarantor, and Oasis Hospitality Partners LLC.

Blue Suede Buys Former Kayak Hotel In Miami Beach

The New York-based investor paid $12.8 million for the 51-room building.

Related Group Lands $142M To Complete NoMad Condos In Wynwood

The condo project will feature 329 units and about 18,500 square feet of retail space.

River District Condo Near Miami’s Allapattah Nabs $68 Million Loan

The developer will permit short-term rentals in the fully furnished units.

JV Acquires 32K SF Ground Floor Retail Space In Wynwood For $700 PSF

Roughly 50 percent of the retail space is pre-leased.

Delilah Owner Eyes Venue On Miami Beach’s Lincoln Road

The Italian establishment would house 358 seats in total, including 96 booth seats and some bar seating.

Three Wynwood Buildings Assemblage Changes Hands

Wynwood 126 acquired the 0.7-acre portfolio that can be redeveloped into a mixed-use project with a hotel or multifamily component.

CRE Company Plans $23M Redevelopment Of Aventura Shopping Center

Avenida Biscayne, a ground-up redevelopment, emphasizes an outdoor-oriented dining experience with large canopies situated adjacent to the restaurant locations.

Lights Now On Five-Park, Miami Beach’s New Tallest Building

It is said to be taller than any other building in the city of Miami Beach, at 519 feet. When complete, it will include 280 luxury residential units.

One Of Wynwood’s Biggest Apartment Buildings Now Open

The project also includes 388 parking spaces, and is among the largest to break ground in Wynwood.

Neology Development’s ‘The Julia’ Residences In Allapattah Receives TCO

The $100 million, 14-story residential tower had 25 move-ins on Day 1.

WeWork’s Last Remaining Miami Beach Office Is Up In The Air

WeWork is the sole tenant in the five-story building.

Gridline Properties Signs Leases With Monster Energy, 7 Others At Wynwood Office Building, Achieving 100% Occupancy

The leases total nearly 40,000 square feet of space.

Trimont Acquires Kayak Miami Beach Hotel

An Atlanta-based real estate firm bought the 51-key property in deed in lieu of foreclosure sale.

Terra’s David Martin Buys Stake In Deauville Miami Beach Site, Plans Reconstruction

The Deauville, a historic hotel built in 1957, was demolished in 2022 after the Meruelos submitted a structural report to the city that determined it was an unsafe structure. It had been shuttered since 2017.

$40M Whole Foods Project In Miami Beach Gets Green Light

The design review board approved the four-story retail building that will house the national grocer and a Wells Fargo branch.

7-Story Hotel Proposed In Miami Beach

On April 25, the Miami Beach’s Planning Board will take a look at the application for the 0.63-acre property located at 1509 and 1515 Washington Ave. Currently, it consists of a thirteen-unit apartment complex and an 11,458-square-foot retail structure.

Fisher Brothers Tops Off Wynwood Mixed-Use Development

The eight-story midrise will bring 308 rental units to market.

First Phase Of Lincoln Road Makeover Funded

The plan is aimed to restore a strong residential component that will also help businesses thrive due to consistent business residents will provide the stores along Lincoln Road.

Indoor Soccer And Padel Facility Planned Near Allapattah Transit Station

The proposal was submitted in accordance with the county’s Rapid Transit Zone regulations, which permit increased density and a reduction in parking, because the property is located a few streets east of the Santa Clara Metrorail Station.

Florida Law Speeds Demolition Of Iconic Buildings in Miami Beach

The law targets oceanfront buildings along a “coastal construction control line,” which delineates how close developers can build to the coast.

Regency Development Group Proposes Five-Story Townhomes In South Beach

The Miami Beach Historic Preservation Board will hear the proposal April 9.

Sumaida + Khurana Proposes Five-Story Office Building In South Beach

The Miami Beach Planning Board is expected to vote on the project at its meeting on April 25.

Raccoon Coffee To Open At Wynwood Haus

The deal marks the first retail tenant at the development.

The Gateway at Wynwood Targeted In $101.7 Million Foreclosure Lawsuit

The Gateway at Wynwood was one of the first office buildings constructed in the Wynwood area.

Aventura MOB Under Construction Hit With Foreclosure Suit

An affiliate of Rok Lending filed suit against Gomez Development Group alleging that the Miami-based developer has defaulted on a $15M loan for the property at 21291 NE 28th Ave.

Miami’s New Julia Apartments Aim At Young Professionals In Emerging Allapattah

The 323-unit Julia is named after Julia Tuttle, the only woman to have founded a major American city.

Blocklong Wynwood Dev Site Listed For $31M

The prospective buyer could redevelop two existing commercial buildings into 450-foot-tall project with 789 resi units under Florida’s Live Local Act.

Rilea Launches Sales Of Rock ‘N’ Roll-Themed Condos In Wynwood

Asking prices for the units at the short-term rental-friendly project range from $600K to $1.8M.

$38 Million Mixed-Use Redevelopment Proposed In Miami Beach

Called the Giller Tower, the seven-story development would total 102,701 square feet at 3915 Alton Road.

Aventura Brightline Station Attracts Another Big Apartment Proposal

The joint venture submitted a pre-application with Miami-Dade County for the project, which would include 334 units, 10% of which would be designated as workforce housing, set atop a four-level parking garage.

Lincoln Road Retail Building Targeted In Foreclosure

The borrower acquired the property for $20.5 million in 2019 and obtained a $17 million mortgage that was securitized as part of a mortgage trust.

Project Breaks Ground Near Proposed Train Station In Wynwood

The project is slated to be finished by April 2025.

Historic Boutique Hotel In Miami Beach Sold, Set To Become Teacher Housing

The 9,160-square-foot property was on the market for four months before the deal closed.

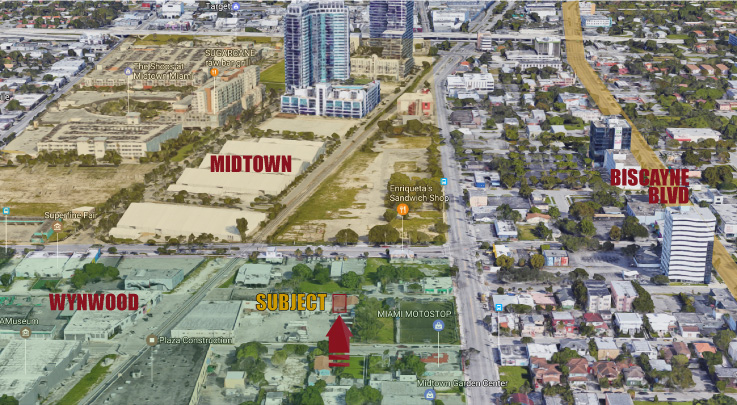

Developers Envision Pedestrian Paradise From Wynwood To The Design District

The rapid growth of Wynwood in the last five years is spilling northward into Midtown as developers look to connect the city’s creative core with its luxury retail center of the Design District, tying together distinct neighborhoods into a unified hub of activity.

Calta Completes Allapattah Assemblage Slated For Mixed-Use Project

Miami-based can move forward after $47M buying spree.

New Class A Office Planned For South Beach

The five-story Class A office building spans 62,500 square feet and is situated across from both SoundScape Park and the New World Symphony.

Bills Threatening Miami Beach Buildings Are Back

At the legislation’s core is a notion that old buildings near Florida’s coast ought to be demolished if a local building official deems them unsafe or if they don’t meet federal standards that call for flood-resistant materials and elevated structures in vulnerable areas.

Developer Proposes 120K SF Office With Studio Apartments In Aventura

The office would front Dixie Highway with a two-story residential building set in the rear of the 1.32-acre site behind the parking garage.

Construction Permits Filed For 186-Unit Wynwood Residential Development

The construction permit application is for a 12-story mixed-use building replacing a parking lot formerly owned by the Salvation Army.

Miami Beach: Where The Magic Numbers Add Up To Investing In Real Estate

Based on the volume of transactions over US$10 million per annum, Miami ranks as the fifth most important property market; only London, New York, Los Angeles and Hong Kong place higher.

‘The Julia Residences’ Open For Pre-Leasing In Miami’s Newest Art District

The stunning $100 million, new 14-story residential tower, characterized by artistic design, is set to grace Miami’s Allapattah neighborhood, with completion expected in the 1st quarter of 2024.

Rentyl Resorts Partners With New Luxury Hotel Brand To Develop, Manage Upscale Historic Hotel In Miami Beach

The project will comprise a chic 44-unit retreat with direct beach access.

Miami Beach Weighs A Hotels Moratorium

A discussion headed to the city commission’s Land Use and Sustainability Committee is to weigh repeal of floor area ratio incentives for hotel developments, a cap on hotel rooms based on zoning districts, and a recently enacted New York model for addressing the limits on approvals for hotels.

Developers Obtain $64 Million Construction Loan For Aventura Multifamily Project

The project was ultimately approved for 184 senior living beds.

New York Developer Secures $18M Construction Loan For Allapattah Project

In 2022, the developer paid $4.6 million for the site. There used to be a car dealership there.

Developers Secure $47M For Rare South Of Fifth Office Building In Miami Beach

The project is the first commercial U.S. commission for Spanish architect Alberto Campo Baeza.

Calta Plans $47M In Allapattah Dev Site Purchases For Workforce Housing

Calta’s project would address the need for more below-market apartments, especially for students and employees at the Civic Center and Health District areas that are near Allapattah.

ABH Developer Group Goes Vertical On Miami’s Wynwood Norte District Project

Completion is estimated for Q2 2024.

Developer Plans Nearly 900-Unit Workforce Housing Project Near Allapattah

The $175M development calls for two 15-story buildings designed by Arquitectonica, next to the Metrorail station.

Shelborne South Beach To Undergo Major Renovation

Drawing from the rich history and heritage of the Shelborne South Beach, the Development Team is committed to preserving the Hotel’s 1940 Art Deco distinction and authentic charm, while modernizing the Hotel through a comprehensive $85 million renovation.

Shvo Secures Approval For The Alton In Miami Beach

Construction is expected to begin next year.

Real Estate Mogul Robert Finvarb Cos. Plans Hotel In Wynwood

He hopes to break ground in Wynwood in the third or fourth quarter of 2024.

Investor Plans To Renovate Miami Beach Hotels

The Miami Beach Historic Preservation Board is scheduled to hear the proposal Dec. 12.

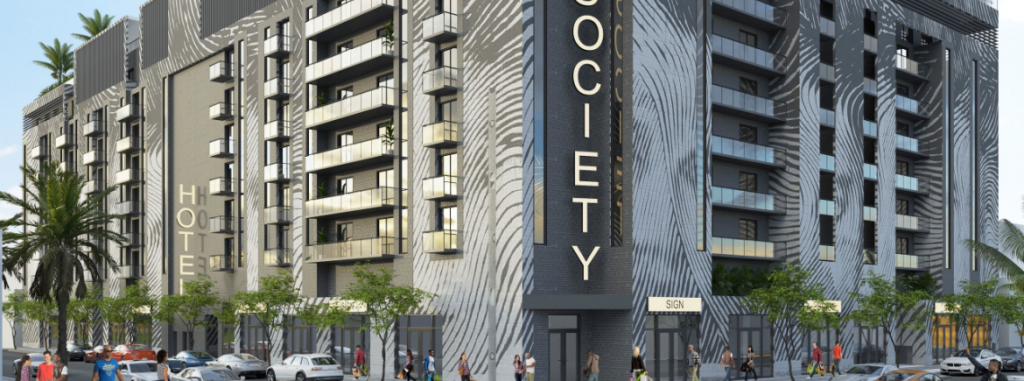

PMG, Greybrook Begin Preleasing Society Wynwood Mixed-Use Project

First move-ins are slated to begin in February 2024.

Dozen Other Art Fairs To Enliven Art Basel Miami

Beginning Dec. 4, Art Basel, Miami Art Week is promising to showcase a week full of world-renowned and emerging artists who are set to exhibit a diverse array of immersive, contemporary and visual art masterpieces.

New York’s Rosemary’s To Open In Wynwood Industrial Building

The casual Italian concept from the West Village in New York will be opening at 310 NW 25th Street.

Wynwood BID Recertified For An Additional 10 Years

During the past decade, Wynwood has experienced an exponential increase in visitors, with the number rising from 240,000 in 2013 to a staggering 15 million annually in 2023. Today, Wynwood supports 5,000 new jobs and generates more than 20 percent of the City of Miami’s parking transactions.

Moon Thai Wants To Build 3-Story Restaurant In Wynwood

The plan will be discussed by the Wynwood Design Review Committee on Tuesday.

Neology Development Group’s ‘Fourteen Allapattah Residences’ Apartments Tops Off

The mixed-use residential tower will deliver 237 upscale studios, one- and two-bedroom apartments to Miami’s Allapattah neighborhood in 2024.

Plans For New Whole Foods In South Beach Submitted To Review Board

The Whole Foods is proposed to occupy the ground floor of a 4-story development at 1901 Alton Road.

Workforce Housing Outperforms But Experts Disagree Why

Regardless, investors appreciate the asset class’ stable cash flow.

JV Agrees To Hero Housing Provisions In Aventura

The Icon Aventura project will be 26 stories and would feature 275 condos, 20 Hero Housing apartments and 12,000 square feet of retail on the ground floor of the new 10-story parking garage.

Wynwood Project To Include 54 Small Housing Units

The development is to become home to 178 residential units, 13,498 square feet of retail uses, and parking for 183 vehicles.

11-Story Apartment Complex Planned Near Brightline Station And Aventura Mall

The developer plans to break ground in the second half of 2024. Construction should take around 18 months.

Securities Exchange Company Takes 38,000 Square Feet In Wynwood

The company also announced on October 17 that it plans to introduce a fourth options exchange platform headquartered in Miami.

Hundreds More Residents Incoming: Wynwood Haus Begins Pre-Leasing

The 20-story apartment tower, which broke ground in June 2021, is set to welcome its first residents by year’s end.

Wynwood Norte Condos Launches Sales

Prices for 24-unit Casa Wyn start at $359,000, but units can be rented out short-term.

Related, W5 Group Begin Leasing Efforts At Wynwood’s First Co-Living Project, i5 Wynwood

The project offers 217 fully furnished private suites starting in the $1,800’s.

Clevelander Submits Plans To Turn South Beach Party Spot Into Housing

The proposal calls for a 200-foot tower above a ground-floor restaurant where the Clevelander currently stands.

Developer Under Contract To Buy 17,000-SF Lot In Wynwood For $7.7 Million

The developer plans to build a 152-unit luxury rental building with ground-floor retail designed by Miami architectural firm Kobi Karp.

Sony Music Coming To Wynwood

Sony Music has signed the largest office lease in Wynwood so far this year, taking 45,000 square feet over two floors in the 10-story office building 545 Wyn.

29 Wyn Apartment Project Sells For $544K Per Unit

29 Wyn consists of a 12-story building and an eight-story building and includes 28,400 square feet of ground-floor commercial space.

Miami Beach To Consider Mixed-Use Development Deal For City Land

The developer wants to pay $2 million over the first three years, as well as $470,000 annually with a 2% annual increase, to lease the lot from the city for 99 years.

Neology Life’s No.17 Residences Allapattah Scores $31.5M Refi

Fannie Mae originated the 10-year loan with five years of interest-only.

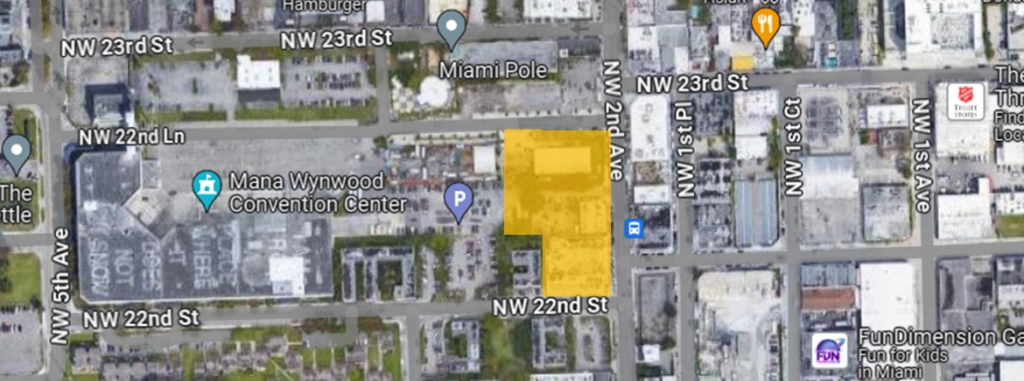

PMG Buys Wynwood Development Site From Lndmrk For $20 Million

Lndmrk Development assembled the seven lots last year, paying $12.5 million in total.

Miami Beach Neighborhood Draws $150M Block-Size Residential Towers Development

Designed by Arquitectonica, the development would deliver a total of 125 residences.

Biophlic South Beach Office Building Designed By Norman Foster Approved By Board

The project It is planned to rise six stories and include 170,000 rentable square-feet of Class A office space, 17,000 square-feet of ground floor retail and five luxury residences.

Miami Beach Office Building Fetches $82 Million

The building has about 110,00 square feet of office, 30,000 square feet of ground-floor retail space and a 499-space parking garage.

Former Miami Beach Mayor Sells Wynwood Complex For $24M

The deal breaks down to $623 dollars per square foot.

Goldman Properties Proposes Work/Live Project In Miami’s Wynwood

The Wynwood Design Review Committee will consider plans for the project on Sept. 25.

5-Story Food And Beverage Venue Proposed In Miami’s Wynwood

If built, the 52-foot-tall, 19,873-square-foot project will be have 318 indoor and outdoor seats on each level, “including an activated roof… .”

Fort Lauderdale Developer Proposes Boutique Building In Miami Beach

The five-story development will feature four residential units, each spanning 1,886 square feet, with additional commercial space.

Aromatherapy Supply Store Aromoa360 Inks Deals For 33,500 SF In Wynwood

The deals mark an expansion for Aroma360, which already leases a 50,000-square-foot warehouse at 1148 Northwest 72nd Street in unincorporated Miami-Dade.

12-Story Office Tower At Wynwood Plaza Tops Out

Upon completion, the office development will total 266,000 square feet and will feature touchless entry and elevator systems, a dedicated parking garage, fitness club, bar lounge, conference and collaboration spaces and an expansive rooftop.

RH Proposes $150M Project To Replace Nikki Beach Club

Akerman, Tao Group Hospitality, and RH submitted proposals, which officials will hear privately. The Penrods missed the deadline to put forth an offer by 15 minutes.

‘Bullish on Allapattah’: Miami’s Next Frontier Of Development

“Allapattah is a [desirable] market, given its location in the Miami urban core and the vicinity to downtown Miami, Wynwood and the Medical District.”

Developer Revises Plans For The Alton Office Building In Miami Beach

The project was initially described as having five floors and 250,000 square feet of offices.

French-Style Cafe From New York To Make Florida Debut In Wynwood

Located at 51 NW 26th Street, the 4,202-square-foot restaurant is slated to open this winter and will function as a flagship location, housing an all-day cafe and bakery, as well as a pastry production kitchen for the South Florida region.

Azora Exan Fattens Its Miami Beach Portfolio With Retail Building Acquisition

The building hit the market earlier this year with an asking price of $19 million.

South Beach’s Clevelander To Be Transformed Into Affordable Housing Development

The new development will transform the legendary Clevelander from its current use as a hotel and bar with outdoor entertainment until 5 a.m. into a residential development with hotel services and a high-end restaurant on its ground floor.

Flexible Office Provider Mindspace Leases 30,000 SF In Wynwood

The tenant will open the Wynwood outpost on Sept. 12.

Redrawn Boundaries May Add Affordable Housing In Allapattah

The proposed affordable housing project planned for the 18-acre city-owned lot in Allapattah could benefit from tax increment financing since its inclusion in the recently expanded Omni redevelopment agency boundaries.

Developer Proposes Workforce Housing In Miami Beach

Totaling 28,074 square feet in four stories, the project would feature 40 apartments and 24 parking spaces on the ground level underneath the building.

Oldest Public Building In Miami Beach Gets New Life

The clubhouse, opened originally in 1916, and the annex, opened in 1937, have been restored as a single entity and now host a restaurant and meeting space.

Iconic New York Pizzeria To Open Its First Florida Location In Miami Beach

The restaurant was once hailed as “one of the more extraordinary restaurants in the country” by The New York Times.

3-Story Food Hall Planned For Aventura

The food hall, dubbed L’Isola, will include select restaurants and vendors with a varied selection of international cuisine, as well as a rooftop restaurant and cocktail lounge.

Construction Permit In Process For 289-Unit Wynwood Urby, Contractor Named

The project was first reviewed by the Wynwood Design Review Committee in April 2022.

Eco Stone Plans $35M Multifamily Project In Allapattah

The firm’s first ground-up project, Eco Landing, nabbed a $23M construction loan from Popular Bank.

Total Demolition Permit Submitted For 2000 Wynwood

A new construction permit to build a multifamily rental building was submitted in December 2022 and is still in process.

Ritz Carlton Owner Proposes 15-Story Tower, Lincoln Road Rebuild

The Historic Preservation Board is set to review the proposal on September 12.

Tricera Capital And LNDMRK Development Secure Several Exciting Tenants At Society Wynwood

The leases total nearly 14,000 square feet.

Wynwood Used To Look Like That? See Early Photos Of What Became A Hip Miami Hangout

Wynwood was a working-class neighborhood, dotted with warehouses and other industrial businesses.

Fewer CRE Loans Being Refinanced, But Lenders Find Other Ways To Work With Borrowers

The haves and have nots have emerged as commercial loans mature. For some loans on the cusp of maturing, the ability to refinance may require more cash from the borrower, especially as lending standards have tightened.

Miami Retail Leads Nation In Rent Growth As Brands, Chefs Follow The Money

Miami retail vacancy is at 3.7%, 50 basis points below the national average of 4.2%, and the city leads all major U.S. markets in rent growth, rising 11.6% year-over-year to $42.40 per SF.

Two Mixed-Use Projects Proposed In Wynwood, With Green & Wood Exteriors

Kushner and Block Capital are shown on the submittal package as the developers.

Residential Building Boom Hits Aventura

Aventura is witnessing a wave of building and infrastructure improvements as well.

Longtime Wynwood Developer Proposes New Office Project

The Doris would total 20,419 square feet, with 1,218 square feet of commercial space on the ground floor and 19,201 square feet of office space on the seven floors above it.

New Mixed-Use Project Coming To Allapattah

Groundbreaking on the project will begin in the third quarter of 2024, with a scheduled completion date at the end of 2025.

W3 Proposed In Wynwood, Painted In Red

A hearing before the Wynwood Design Review Committee is scheduled for July 18.

Fontainebleau Scores $73M Construction Loan For New Convention Center

The five-story, 50,000-square-foot facility is being erected on a 1-acre lot at 4360 Collins Avenue, just south of Fontainebleau’s condo component.

Miami-Dade County Most Competitive Rental Market In U.S.

“Developers in Florida have been busy completing new apartments. However, this is still not enough to keep up with pent-up demand, which is why Florida markets are claiming the first spots on our list,” the RentCafe report stated.

Fisher Brothers Bag $118M Loan For Wynwood Project

The 1.5-acre development site is the former Miami Rescue Mission headquarters.

The Gateway At Wynwood Lands 10K-SF Indoor Climbing Gym

The lease deal brings the retail component of The Gateway at Wynwood, which spans 25,000 square feet, to full occupancy.

13th Floor Assembles Oceanfront Miami Beach Site With $73M Buy

Combined, 13th Floor Investments’ assemblages span 1.18 acres, and is a likely target for condo development.

Eight New Tenants Set To Open On Miami Beach’s Lincoln Road Promenade

Lincoln Road also recently extended its partnership with Smorgasburg for another year. The open-air food market featuring dozens of local vendors takes place every Friday from 5:30-10:30 p.m. on Lincoln Road’s 1100 block and has become a local favorite hot spot.

Fisher Brothers Looking To Crowdfund $29M For Wynhouse Miami Development

Construction is set to be fast-tracked for a January 2025 completion date.

Wynwood Seeks New Life For Its Economic Growth Engine

Pending approval by a majority of business owners within the area, the BID is set to officially be renewed for another 10 years on Nov. 6.

Mixed-Use Building To Rise Where Wynwood And Edgewater Meet

Along with the residential uses, the building is to include 25,653 square feet of retail and 18,713 square feet of amenities.

Miami Heat Star Partners With Developer On Wynwood Project

The affordable housing project will consist of 48 studio apartments, 66 one-bedroom units and eight two-bedroom units with rents ranging from $512 to $1,756 per month.

Miami A&E District Fitness Center Slated For Redevelopment

The preliminary plans are for 430 apartments and 15,000 to 20,000 square feet of commercial space on the ground level in about 48 stories.

Is Retail The New Darling Of The CRE Industry?

There are a lot of reasons to think that it is.

Retail Landlords Urged To Embrace Flexibility In The Face Of Bankruptcies

Rrecent bankruptcy filings from prominent big-box retailers and smaller chains, such as Bed Bath & Beyond, Buy Buy BABY, David’s Bridal, and Tuesday Morning, have sent shockwaves through the industry.

Developers Plan Apartments On Allapattah Auto Dealership Site

Development in Allapattah, a working-class neighborhood west of Wynwood, is booming in response to Miami’s increasing real estate prices over the previous three years.

Newmark Arranges $91 Million Financing Of Kushner Companies, Block Capital Group’s Wynwood 27 & 28

The Newmark team was led by Jordan Roeschlaub and Dustin Stolly, Co-Presidents of Debt & Structured Finance, along with Executive Managing Directors Christopher Kramer and Nick Scribani, as well as Senior Managing Director Danny Matz from the Miami office.

Steven Oved Buys Boutique South Beach Hotel For $15M

The hotel was built in 1939 in classic Art Deco style, and its facade was restored while it was owned by Marcelo Tenenbaum of Blue Road Development, which purchased the hotel for $1.1 million back in 2010.

Wynwood Dev Site Goes On The Block For $30M

Potential buyers can redevelop the properties into an eight-story to 12-story mixed-use project with either 108 residential units or 216 hotel rooms.

‘Skyline Of Miami Gardens.’ Formula One Museum, Hotels, Apartments Planned Near Hard Rock

Immocorp joined with The Faith Group and Azur Equities to spearhead the development.

Miami Beach South Of Fifth Projects Could Score More Density

Legislation aims to incentivize property owners to convert hotels into residential buildings.

Rishi Kapoor’s Co-Living, Micro-Unit Project In Miami Beach Scores Approval

Kapoor’s Location Ventures had planned to have three-month leases, but commissioners imposed a six-month minimum term.

ABH Developer Group Completes Development Site Assemblage In Wynwood Norte, Becomes Largest Stakeholder In The District

The firm has 13 projects ranging from 24 to 150 units in various stages of development just within the Wynwood Norte boundaries.

Multifamily May Outperform Expectations in Q2

The news is according to CoStar Group, which is basing this premise on April’s rental numbers that are showing every sign that the sector is beginning to stabilize.

Real Estate Lending Firm To Open 8,000-SF Wynwood Office

The company opted to stay in Wynwood because the location “symbolizes the trends and growth potential of the Miami market as the neighborhood has emerged as a marquee hub for young creatives — not unlike Brooklyn and Arts District Los Angeles,” the company stated.

Moishe Mana Plans $20M+ Redevelopment Of RC Cola Plant In Wynwood

The project will include nine indoor food and beverage tenants, food trucks and 10K square feet of parks.

JV Proposes 10-Story, 115-Key Hotel In Wynwood

The proposed 10-story hotel will cost an estimated $20 million to build.

Spanish Sports Retailer Pādel Nuestro Signs Wynwood Lease

The new store is less than two miles from Wynwood Padel Club, which has eight courts, and Real Padel Miami. It will feature a demo area where enthusiasts can test gear.

Kushner, Faith Group And Immocorp Capital JV Plan Mixed-Use Apartment Project In Wynwood

A joint venture of Kushner Companies, Faith Group, and Immocorp Capital plan 325 apartments with about 20,000-25,000 square feet of retail.

Miami Beach Imposes Regulations For Fractional Ownership Homes

The fractional ownership ordinance largely targets Pacaso, a San Francisco-based tech company that allows investors to purchase as little as a one-eighth interest in second homes.

Apartment Rents Forecast To Grow 0.8% Next Year

In contrast, rents grew a relatively robust 4% this year.

Recertification Voting Continues For Miami’s Wynwood Business Improvement District

Currently, there is 600,000 square feet of commercial retail space under construction as Wynwood continues to evolve.

Kayak Miami Beach Hotel Targeted In $14M Foreclosure

The hotel includes the Layla restaurant, the Parasol snack bar and a rooftop pool.

The First Hotel In Miami’s White-Hot Wynwood Is A Temple Of Great Food, Fun Drinks And Cool Design

Reflective of its community, Arlo Wynwood will moonlight as a living canvas for a curated group of artists that spark curiosity from art connoisseurs and novices alike. Arlo Wynwood’s interiors will display more than 250 works of art from a range of artists.

Electrical Union Looks To Rezone Its Allapattah HQ For New Mixed-Use Development

The union wants to change the zoning from “T6-8-O” and “high-density residential” to “T6-12-O” and “restricted commercial.” The density would be 150 units per acre, which would equate to 275 units on a site of this size.

Multifamily Series: How Affordable Housing Is Changing

The shortage of affordable multifamily housing continues nationwide. The good news is that developers and architects are bringing solutions to the multifamily market. It’s no secret that affordable housing is in short supply. Both the single-family and multifamily market struggle to meet the need. According to the National Low Income Housing Coalition, not a single one […]

The Dorsey Mixed-Use Project Gets $165M Refi

Berkadia Managing Directors Scott Wadler, Brad Williamson, and Matt Robbins, Senior Managing Director Mitch Sinberg, and Vice President Michael Basinski of Berkadia South Florida arranged the loan on behalf of the Miami-based sponsors.

Foreclosed Wynwood Site Fetches $26M

The approved plans included 180 residential units, 70 hotel rooms and 9,508 square feet of ground-floor retail.

After Years-Long Saga, County Will Take Over Hundreds Of Miami Beach Affordable Units

Under a deal approved by the Miami-Dade Board of County Commissioners last week, the Miami Beach Community Development Corporation will transfer ownership of its 16 buildings, totaling 357 income-restricted units, to the county, which manages thousands of affordable units countywide.

Wynwood-Edgewater Mixed-Use Midrise Wins Backing

Wynwood 21 is to be home to 97 dwellings, about 3,550 square feet of restaurant, and 2,538 square feet of retail.

The Canvas Multi-Brand Platform Expands Into 5000-Square-Feet Miami Wynwood Residence

Canvas is taking over the ground floor space previously occupied by Solana Spaces.

Developers Looking To Buy Commercial Sites Due To New Legislation

The Live Local Act, which Gov. Ron DeSantis signed aims to help fill financing gaps, making more developments economically feasible. What is still crucial, attorneys and developers said, is combining that with incentives on the local level.

Commercial Real Estate Miami Beach Apartment Building Auctioned In Bankruptcy

The 29-unit apartment hotel was set up for short-term rentals.

Developer Exploring Second Co-Living Project On Miami Beach

City commissioners granted preliminary approval for zoning changes that would benefit the developer’s plans.

Sale Leaseback Cap Rates Continue To Attract Investors

This year there has been a growing return of confidence for the market.

To Ease Rent Crisis, Miami City Commission May Change Zoning Code To Allow For Communal Living Developments In Wynwood

After gaining notoriety as the center of the housing crisis in the US, Miami is looking to co-living developments to calm soaring rent prices.

Are Multifamily Prices Coming Down Soon?

Both buyers and sellers have their brakes on because many buyers can’t figure out what a property is really worth today.

Wynwood Development Gets Boost With $67 Million Construction Loan

The project has been approved for 210 apartments and 11,500 square feet of retail space.

Terra Offers $500M For Oceanfront Miami Beach Condo Building

The price averages out to $877,192 per unit.

Centner Academy Owners Assemble Land In Wynwood

The seller paid just $275,000 for the lots in 2011, marking a 16-fold price increase in 12 years.

Mast Capital, Rockpoint Underway On Nine-Story Multifamily Project In Miami Beach

Mast Capital and Rockpoint broke ground on the development in February 2023 and plan to open the community by fall 2024.

Former Red Sox Star’s Omni New York Proposes Wynwood Apartments

Omni 21 would have 97 apartments, 5,865 square feet of retail space, 130 parking spaces, including 25 spaces for electric car charging, and 166,960 square feet of space across 11 levels.

Clearline Real Estate Reveals Plans For Apartment Project In Wynwood

Totaling 435,286 square feet in 11 stories, the building would feature 310 apartments, 9,909 square feet of commercial space and 311 parking spaces.

South Beach Hotel Could Be Seized In $7.4M Foreclosure

It’s currently called the Onu Hotel, although it’s also been known as the SoBe Hostel.

L&L, Oak Row Land New Tenants, Start Construction On 1M SF Wynwood Plaza

When it opens, which is expected to be in 2025, the Gensler-designed Wynwood Plaza will feature a 509-unit apartment building, 32K SF of retail, 6,600 SF of outdoor dining and a half-acre public plaza.

Intervest Seeks to Convert Historic Miami Beach Rental into Hotel

The Miami Beach Historic Preservation Board will hear the bid March 14.

Wynwood Business Improvement District Marks Decade Of Success

In partnership with area businesses, owners, developers and residents, working with the City of Miami, the Wynwood BID has been a significant catalyst in the neighborhood’s growth, improving quality of life, and in ongoing synergies between new investors, and existing businesses and cultural venues.

Related Group’s Nick Perez On Wynwood’s Transformation And The Future Of Development In This Burgeoning Neighborhood

Related is betting big on the future of Wynwood’s luxury residential market with NoMad Residences Wynwood, the first hospitality-infused condominium from the iconic brand, NoMad Hotels.

One-Acre Office Building Dev Site In Aventura Trades For $10 Million

The seller paid $781,800 for the land and other lots in 2019.

Tricera Capital, Related Group Announce Schonfeld Strategic Advisors Lease Expansion At Wynwood’s The Dorsey

The lease expansion brings the Dorsey’s office component to 100-percent occupancy.

Julia Tuttle Causeway May Be In Line For An Overhead Expressway

Issues to be studied include the lack of bicycle and pedestrian connectivity between Miami and Miami Beach – which could create a connection between existing bicycle lanes in Miami Beach.

AT&T Could Sell Miami Beach Site To Developer

The site plan calls for a 10-story building totaling 134,573 square feet with 96 condos, 2,192 square feet of retail and 90 parking spaces.

Gateway At Wynwood Gets $113 Million Refi

The property is leased to a diverse tenant roster including BoConcept, OpenStore and Veru.

Employment Seekers From Around US Attracted To Florida Jobs

Along with these white-collar jobs, is the demand for workers to fill blue-collar jobs.

South Beach Hotels Sell For $335 Per Room

The hotels last traded for $12.25 million in 2009, more than doubling in value.

Rilea Pays $6M For 13K SF Warehouse Property In Wynwood, Plans More Mohawk At Wynwood Loft Apartments

In an off-market deal, Rilea bought the property from interior designer Michael Wolk, whose studio is based in one of the warehouses.

Huge Flight Of Talent & Capital To Miami Continues, Investor Says

“I like to think of Miami as a viral product with very high retention,” Abraham said, noting that his friends who had tried Miami had stayed. “I don’t know anyone who’s gone back to Silicon Valley or New York.”

South Florida’s Allure In 2022 Made Miami-Dade’s Business Opening Among Best In U.S.

South Florida added thousands of new businesses in 2022, putting the region in the top three metropolitan areas nationwide for openings of everything from retailers to law offices.

Florida Bill Turns To Developers To Tackle Affordable Housing

A Senate proposal would provide tax breaks and eliminate rent control.

Mixed-Use Project Proposed To Replace Parking Lot In South Beach

The city’s Finance and Economic Resiliency Committee is scheduled to discuss the proposal at a January 27 meeting.

9-Story Apartment Tower Proposed Near Aventura

In order to build this project, BH Group wants the county to rezone the site from Ojus Urban Area District-Edge to Ojus Urban Area District-Center.

RFR, Tricap File Dueling Lawsuits For Control Of W South Beach

The New York real estate firms partnership has hit its breaking point over a maturing loan.

Wynwood Plaza Project Scores $215M Construction Loan

The project includes a 12-story, 266,000-square-foot office building, a 509-unit luxury rental building, 32,000 square feet of indoor and outdoor retail space, and a 26,000-square-foot public plaza.

Hotel Development At Miami Beach Convention Center To Move Forward

Vertical construction of the Grand Hyatt Miami Beach Convention Center Hotel is expected to begin later this year and completion is expected in 2025.

AIRC Buys Miami Beach Apartment Complex For $250M

Totaling 554,694 square feet, Southgate Towers was built on the 4-acre site along Biscayne Bay in 1958.

Developer Obtains $277M Construction Loan For Hotel And Condo In Miami Beach

The hotel tower will feature 56 rooms and 22 condos, while the stand-alone condo will have 41 units.

Fabel Rooftop Restaurant Opens At Robert Rivani’s Wynwood Jungle

The 254-seat venue is set across 10,000 square feet of a secured open-air, covered rooftop.

New Apartment Demand ‘All But Evaporated’

There is weak demand for all types of housing despite robust job growth and sizable wage gains.

NY Firm Sells Miami Beach Mixed-Use Building At 40% Loss

Although the deal comes as distressed sales are expected amid rising interest rates, the Collins Avenue building didn’t trade at a discount because of debt issues.

Record New Business Applications Can Fuel Miami’s Economy

Small businesses can get an SBA helping hand ranging from microloans that average $13,000 and max out at $50,000 for startups to $5 million for other types.

Chetrit Group To Transform Miami River Waterfront With 4MSF Of Residence, Office, Retail, Hospitality

When fully completed in 2026, the River District will comprise four million square feet of new development, including 1,600 residences, Class A office space, 30,000 square feet of retail, a boat marina that can accommodate 60-foot vessels, 2,000 covered parking spots and restaurants and nightlife venues.

Four Projects Coming Soon To Wynwood

The evolution of the Wynwood Arts District in Miami continues with new condos, hotels, office, and retail buildings replacing the old graffiti-decorated warehouses that once served as artist workshops, galleries, and factories.

Craig Robins’ Dacra Buys Miami Design District Portfolio For New Mixed-Use Dev

Robins’ firm Dacra, together with several partners, bought a 15-building portfolio along NE 39th Street for nearly $200 million in a deal that closed December 22, according to people familiar with the transaction.

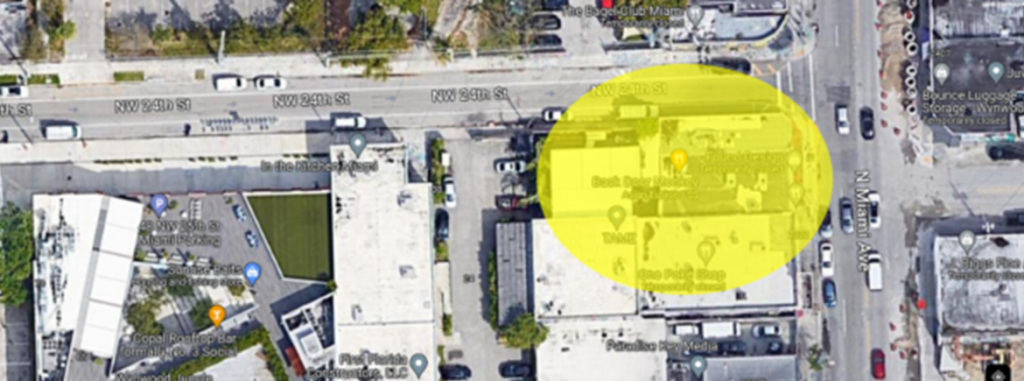

Turnberry Turns To Wynwood, Plans Mixed-Use Hotel Project

Aventura-based Turnberry, led by Jackie Soffer, paid $13.1 million for the properties at 127 and 135 Northwest 24th Street and 128 and 138 Northwest 25th Street.

Wynwood Norte Development Site Sells For $9 Million

The developer recently announced plans for Evolve Wynwood, a 141-unit apartment building that will offer market-rate rentals in the Wynwood neighborhood.

Wall Street Influx Continues With Miami Beach Lease of 12K SF

Tech and finance firms have been flocking to Miami Beach.

Hotels Partner To Upgrade Lincoln Road

A beautification project to improve unkempt areas on the east end of Lincoln Road between the commercial district and the beach walk is advancing with the help of the owners of the Ritz-Carlton and the Sagamore South Beach hotels, who are investing millions of dollars.

Cube Wynwd Trades For $62 Million

The sale to Brick & Timber Collective closed on Dec. 13. As part of the transaction, Tricera and LNDMRK retained an undisclosed ownership stake in Cube Wynwd.

Mixed-Use Allapattah Project Gets A City Green Light

Called Legacy 20th Street, the multi-family development will be home to 289 residential units, 3,750 square feet of retail, and 368 parking spaces, at 1400 NW 20th St.

Developer Aims To Boost Density Of Project Near Aventura Brightline Station

The project will total 318,652 square feet.

Moishe Mana Nabs $275M Credit Line For Wynwood Assemblage

The portfolio spans 17 low-rise properties in the southwest section of Wynwood, a Miami neighborhood known for its colorful murals that’s welcomed a slew of tech companies in the past two years.

Wynwood Streetscape Plan Under City’s Microscope

The streetscape plan’s main aspects are to strengthen a sense of place, neighborhood identity through new green space and artsy aesthetics and improve the public landscaping experience.

Developers, Brokers Pursue Wealthy Art Buyers During Miami Art Week

Major real estate players, who happen to be art enthusiasts, are also hosting events that aren’t real estate related.

Bazbaz Buys Wynwood Development Site For Mixed-Use Project

The NY-based developer plans to build 229 apartments, 79 hotel rooms, plus office and retail.

Commuter Rail From Downtown Miami To Aventura Getting $103M From FDOT

The service is expected to run 5 AM to midnight, with 60 minute headways. During peak morning and afternoon weekday rush hour times, headways would be 30 minutes.

Plans Submitted For Mixed-Use 1920 Alton, Designed By Gensler

A hearing before the Miami Beach Design Review Board is scheduled December 6.

Tech, Finance And Dining Fuel Wynwood Realty

Over the past three to four years, Wynwood has been transformed thanks to vertical development.

Miami Beach Seeks Development Partner For Art Deco Apartment Building

The City would consider proposals for an office or multifamily project with workforce housing.

Brightline Says Aventura Train Service Will Begin Within Weeks, Take 17 Minutes To Downtown

New details of operations in Aventura were released

Lincoln Road Poised For Retail Revival

With 16 new-to-market retail and restaurant tenants, 12 under-development stores, and a greater foot traffic than other Miami-Dade County destinations, Lincoln Road continues to be successful and is poised to have its retail revival going.

Miami Beach Votes Down Big Real Estate Projects

Miami voters meanwhile greenlighted a major development.

Budding Urban Arts Hub Allapattah Getting Discounted Homes

Single renters would qualify if they earn $47,810 per year — 70% of Miami-Dade’s median income of $68,300 — or less.

Wynwood Site Seized In $30M Foreclosure Judgment

Gamma FL Wynwood LLC, in care of New York-based Gamma Real Estate, won the foreclosure auction in September against New York-based Wynwood Gateway II LLC based on a $23 million mortgage, plus interest and fees.

Shvo Wants To Redevelop Aging Lincoln Clock Tower Building

The tower would mark Shvo’s third office project in the city.

Aventura Condo Project Moves Forward

The plot is situated just off Biscayne Boulevard, at 2785 NE 183rd St.

School Of Whales Crowdfunding Project Will Turn Miami’s Historic Post Office Into Food Hall

While the property is currently in the final stages of planning, a number of tenant selections have already been secured and two floors fully renovated.

Three Lots Slated For Brickell Megaproject

A developer is planning three residential towers and marina on Miami River near Brickell City Centre.

The Fontainebleau Miami Beach To Add 50K SF Events Center

Plans call for two ballrooms, 10 breakout rooms and a 9,000-square-foot rooftop deck. An indoor sky bridge will connect the events center with the hotel’s Tresor Tower.

Texas Restaurant Group Inks First Deal In Wynwood

The restaurant will lease the entire space, nearly 14,000 square feet.

Rilea Group Plans Short-Term Rental In Wynwood

The project would total 237,823 square feet in 12 stories, with 130 apartment/hotel units, 6,439 square feet of retail and 146 parking spaces.

Salvation Army Sells Wynwood Site For $526 PSF

According to an analysis of the development potential of the site by Miami-based Deepblocks, the property could be developed with 118 residential units in up to 12 stories.

Trio Of Boutique Miami Beach Hotels Sell For Combined $100M

Miami’s hospitality industry is recovering well post COVID-19. More than 24,000 tourists came to Miami-Dade County in 2021, about the same as pre-pandemic levels in 2019, according to data from the county’s tourism board. The number of Miami hotel rooms booked this summer was more or less on par with the busy winter months.

Busch Family Partners With Assouline Capital To Buy Red South Beach Hotel

Longtime owner Simon Nemni sold the 110-key hotel for $33 million, equating to $300,000 per key.

Miami Beach Looks To Expand Perks To Lure Developers To Build Cheaper Homes

The Miami Beach commission voted unanimously this week to waive a slew of fees that developers wouldn’t have to pay, if they build lower priced homes for local workers.

Miami Beach OKs Apartment Building Conversion To Boutique Hotel

The Henry Hohauser-designed building was constructed in 1939 as a 50-key hotel.

Another Wynwood Dev Site Hits The Market Asking Above $30M

Investor Joseph Cohen is looking to sell a 1-acre assemblage for $35M, weeks after Thor Equities put up a smaller site for $32M.

Michael Shvo Plans Second Miami Beach Office Project

A New York developer has proposed a development on Washington Avenue in South Beach.

The State Of Multifamily Investing In South Florida

South Florida’s apartment buildings traded at record highs in the first half of 2022.

Activists Demand Affordable Housing On Allapattah Land

Community leaders in Allapattah will call on Miami officials Thursday to incorporate affordable housing, green space and community services into a nearly 19-acre site poised for development.

South Beach Retail Property Trades For $39 Million

An investor vacant Alton Road property months after selling nearby strip to Michael Shvo

Evolve Acquires Wynwood Property, Housing Development Planned

The development sits within the northwest corner of Wynwood just off Interstate 95, near where the Design District, Model City and Allapattah meet.

Swiss Real Estate Firm Acquires Rare Development Site West Of Brickell

Empira plans to start construction of CoralGrove Brickell in the second half of 2023.

Macy’s Building On South Beach Sells For $15.5M

The building was developed on the 1.15-acre lot in 1953.

Neology Secures Construction Loan For Third Apartment Community In Miami’s Allapattah

Fourteen Allapattah Residences will consist of a 14-story building with 180 apartment units connected via a pool deck to a five-story building with 57 apartments including ground floor walk ups.

Miami Area Expected To Add 19,000 Apartments In 2022

Just two other metro areas are expected to build more apartments than Miami this year.

Miami Beach Voters Pass Referendums Approving More Density For Some, Less For Others

A ballot measure that would force developers who are building in vacated city alleyways and side streets to get voter approval to increase their projects’ floor-area ratio also passed,

Thor Equities Lists Wynwood Dev Site For $32M

The site includes five lots approved for an eight-story building with 211 rooms and nearly 32K square feet of commercial space.

Longpoint Buys Shuttered Trailer Park In Allapattah

Industrial developer acquired a nearly 6-acre site near Miami International Airport.

With Pricey Rents In Miami Beach, Developer Plans Cheaper Apartments For Local Workers

Alan Waserstein, owner of Miami Lakes investment and development firm LeaseFlorida, plans to build a four-story development called Mia, containing the 400-square-foot studio apartments and retail space on the ground floor, at 1960 Normandy Drive, according to plans filed to the city of Miami Beach’s Design Review Board.

Construction Permits Filed At High-Tech Lynq Wynwood Office Campus

The developers have previously said the project would be the most high-tech office campus in Miami.

Miami-Dade Seeks Partners For Allapattah Redevelopment

The July decision to issue an RFP for that site came after Miami-based NR Investments made an unsolicited proposal to develop a mixed-use complex there with a hotel, offices, retail and multifamily, with some workforce housing.

Studies Completed For Miami Beach Rapid Transit, People Mover To Design District

Current plans are for a monorail system to Miami Beach, and a Metromover-type system to the Design District.

Wynwood Plaza Submitted To FAA, With Construction Permit Getting Closer

According to the July 26 submission to the FAA, the tallest height of the project is planned to reach 212 feet above ground, or 225 feet above sea level.

Brick & Timber To Buy Cube Wynwd Office Building For $60M

The eight-story, roughly 100,000-square-foot building was completed in 2019 and is almost fully leased.

Here’s A Look At Wynwood’s First Hotel, Opening This Fall

Arlo Wynwood is set to be a nine-story, 217-room property boasting a rooftop pool with private cabanas, a bar, a café and a yoga deck.

Former Low-Income South Beach Apartments Hit Market As Possible Hotel Conversion

The 25-unit property operated as a low-income, housing tax-credit apartment building until April when the restrictions expired, the listing states.

NR Investments Files Proposal To Build Mixed-Use Complex In Allapattah

NR Investments wants to build 2,500 apartments; 300 hotel keys; 200,000 square feet of office space; and 100,000 square feet of retail, the plans show.

Starwood Cancels Purchase Of Miami Beach Office Building

Starwood will likely lose the $2.5 million deposit it made when the property went under contract. If Starwood had pulled out of the deal only a week earlier, it could have recovered that money, according to the source.

Billionaire Stephen Ross’ Deauville Resort Redevelopment Plan Could Soon Be Up For A Vote

Ross, the chairman of New York-based Related Cos., and New York-based architect Frank Gehry presented the Commission with preliminary plans for a 175-room hotel tower and a 150-unit condo tower.

8-Story Building Proposed In Allapattah

The building would total 103,819 square feet, with 2,138 square feet of ground-floor retail and the rest of the space for self-storage.

Miami’s CBD Is Getting Mind-Boggling Office Rent Increases

Brickell is dominating the market — its 42% year-over-year rent increase surpassed Manhattan and Los Angeles, according to a report.

300-Unit Apartment Complex Proposed In Miami’s Wynwood

The FB Wynwood building would total 359,694 square feet in eight stories, with 308 apartments, 21,724 square feet of retail and 122 parking spaces.

Office Project Could Replace Gas Station In Miami Beach

With an estimated cost of $11 million, the project would total 67,641 square feet in five stories. It would consist of 3,300-square-foot of ground-level retail, 36 parking spaces on the second level, 17,113 square feet of office space on the third and fourth floors, and a fifth floor containing an 8,000-square-foot live/work unit.

Recently Built Condo In Miami’s Wynwood Hit With Foreclosure Lawsuit

The five-story building was completed a few weeks ago. None of its units have sold, according to county records.

Continuing Interest In Miami Beach Leads To New Wave Of Luxury Hotels

Miami Beach’s continued upscaling has helped spur a flurry of additional renovation projects, said Steve Adkins, chairman of the Miami Beach Visitor and Convention Authority.

“It’s On Fire.”: Miami Mayor Touts South Florida Economy

Miami Mayor Francis Suarez made an appearance on Fox Business where he discussed Miami’s booming economy, referring to it as “on fire,” as the city posts repeated increases in real estate sales, an influx of new jobs, and the welcoming of tech businesses from states like California and North Carolina.

New Office Tenants And New Development Balance Out Vacancy In Miami

While the economy has had a turbulent few years — with a global pandemic, record inflation and political drama — the vacancy rate in Miami’s office market has remained fairly static, as the horde of new-to-market tenants was balanced by new development, according to second-quarter research from Colliers.

Plans Submitted To FAA For Massive Redevelopment At Miami Arena Site

The project is slated for 2,351 residential units anbd 540,000 square feet of office space.

Housing Trust Group Plans Apartments Near Aventura

Totaling 104,344 square feet, the eight-story Oasis at Aventura would have 95 apartments and 65 parking spaces. Amenities would include a gym, a club room and an outdoor terrace.

Well-Known Challenges Could Impede Miami’s Tech Growth

Two new studies substantiating Miami’s tech hype also reveal how much we must do to make that growth path pivotal to our economy. The jury is out about whether we can meet that challenge.

The Gateway At Wynwood Welcomes Three New-to-Market Tenants

The new leases total nearly 14,000 square feet.

County May Seek Bids In July To Redevelop 20 Acres Of Downtown Miami

It would include affordable and workforce housing, market-rate housing, open spaces such as parks, office space, a new library, a new historical museum, and a downtown intermodal terminal to provide bus bays for all buses terminating in the Government Center area.

Wynwood Buildings More Than Quadruple In Value

The buildings were constructed in 1971 and 1925, respectively. The site covers 33,320 square feet.

Goldman Properties, JV Of Scott Robins And Philip Levine Propose Wynwood Projects

If the Wynwood Design Review Board approves the proposals, construction of both is expected to be completed in the second half of 2024.

Miami Beach Hotel Sells For $684,000 Per Key

The company will invest approximately $60 million to reposition the hotel into a premiere beachfront resort under Hyatt’s luxury, lifestyle Andaz brand.

Miami-Dade County Taxable Property Value Posts First Double-Digit Growth Since 2007

The taxable value of properties rose by $34 billion to a total of $372 billion, or a whopping 10.2% jump, between 2020 and 2021.

AMAC, ROVR Score $67M Construction Loan For Aventura Park Multifamily Project

Construction is expected to be completed in early 2024.

Miami Worldcenter Tower Project To Total 160,000 Square Feet After Land Purchase

Miami-based Royal Palm Cos., led by Daniel Kodsi, paid $4.45 million for the 7,500-square-foot property at 61 N.E. Ninth St.

Dolphins Owner Stephen Ross To Buy Deauville Hotel, Plans Luxury Complex In Miami Beach

The MiMo-style hotel has remained vacant following an electrical fire in 2017. The property fell into such disrepair that a Miami Beach official issued a demolition order in January, deeming the building structurally unsafe.

Bakehouse Art Complex In Wynwood Gets City Grant For Building Upgrade

Bakehouse opened in 1985 to provide a permanent and affordable working home to artists of merit with financial need.

Tucandela Buys Wynwood Building To Open Latin-Themed Nightclub

The Wynwood club is slated to open the first quarter of next year.

Wynwood Development Site Targeted In $23M Foreclosure

According to the complaint, Gamma issued the $23 million mortgage to Wynwood Gateway II in 2019. The loan matured June 30, 2021, without being repaid, and the borrower owes the full amount of principal, plus interest.

Boutique South Beach Hotels Trade Amid Heightened Demand

“These types of properties that have zoning for short-term rental are very difficult to find. I have a list of people who want to buy them. They’ll buy as many as I have,” Gale said. “It’s a coveted type of property, and it has to have the right kind of zoning.”

Big Changes In Little Haiti: Redevelopment Rises In Emerging Neighborhood

Industry insiders say there are plenty of opportunities for more stakeholders to build projects there.

Hyatt Proposes Massive Mixed-Use Project In Downtown Miami

The James L. Knight Center would be demolished under the plan.

South Beach Retail Building Sells For $12M

The property is located between Alton Road and Washington Avenue within South of Fifth, also known as SoFi, a dense restaurant corridor that has become a hotspot for luxury residential and hospitality and one of the premier restaurant destinations in the world.

Moishe Mana Pays $16M For Commercial Assemblage In Allapattah

The developer acquired 10 properties just west of I-95 and Wynwood.

Leasing Activity Heats Up At The Gateway at Wynwood

As Miami continues to experience a post-pandemic boom, The Gateway of Wynwood – the newest office building in the Wynwood area – announces tech start-up OpenStore’s expansion and the growth of its impressive roster of tenants with the addition of two new leases.

City Review Narrowly Recommends Major Wynwood Project

Two buildings are proposed, with a total floor area of 922,466 square feet, on property between Northwest 24th and 25th streets.

Firm Tied To Moishe Mana Buys Retail Properties In Miami’s Allapattah For $16M

The deal covers 35,639 square feet of commercial properties and a 1,120-square-foot single-family home.

RFR Buys Third Building On Miami Block For $451 PSF

RFR appears to be positioning itself for a major real estate investment in a prime site opposite Bayfront Park.

Lender Takes Control Of The Collective’s Wynwood Dev Site Through Foreclosure Auction

The Collective was placed into administration — the equivalent of Chapter 11 bankruptcy protection — in the U.K. last year.

Aging Beachfront Condo Towers Are Hot Properties In Miami Beach

Developers are targeting hundreds of apartment buildings nearing a 40-year limit on structural certifications.

Miami Beach Apartment Complex Could Be Redeveloped Into Hotel

The property currently has three apartment buildings of two stories each with a combined 20 units. It was built in 1946.

Truck Sales Lot With Potential For 400 Rental Units Sold In Allapattah Neighborhood

The property last traded in 2016, when it was seized following a foreclosure lawsuit. It operated as a truck and heavy equipment dealership.

Strong Demand For Office Space At Wynwood Plaza, Utilities Deal Inked

Active negotiations for 75,000 square feet of office space at the project are now underway.

South Beach Office Building Sells For $52M

The 137,579-square-foot property offers 243 parking spots, 46,000 square feet for offices and 22,000 square feet of street-level retail, most of which is leased to CVS.

Art By God Building In Wynwood Could Be Redeveloped

The Wynwood Design Review Committee will consider plans for Wynwood Urby on April 12.

Former Kushner Exec Buys Miami Development Site In Wynwood

Jenny Bernell, former executive vice president of development at Kushner Companies, paid $19.1 million for the assemblage. The seller paid $5.6 million for the properties between 2003 and 2007, records show.

‘A Gift To The City.’: This $4 Billion Development Is Creating An Outdoor Museum In Miami

The program was spearheaded by prolific curator and art dealer Jeffrey Deitch and the team at Primary, a Miami-based curatorial collective that focuses on public art.

Rubells Expand Allapattah Art Space With $11M Industrial Building Purchase

The property was the former headquarters of the family-owned and operated Rex Discount.

Miami Beach Leaders Want Office-Housing Towers Off Lincoln Road. Will Locals Approve?

The city-approved plans are part of a larger effort to diversify the community’s economy amid South Florida’s migration of professionals working largely for tech and financial services companies.

8-Story Sister Wynwood Office Buildings Get OK

The two buildings are proposing together nearly 250,000 square feet of offices.

800-Plus Apartments Could Break Ground Near Aventura Mall, Future Brightline Station

Modera Aventura would have 840 apartments, 15,245 square feet of retail facing West Dixie Highway and 1,096 parking spaces.

The Numbers Behind South Florida’s Multifamily Boom

With investors and renters continuing to flock to South Florida, the region has proven itself to be a promising real estate market and the multifamily sector has been strong.

Wynwood Office, Retail And Parking Portfolio Hits Market For $28M

The listing includes a three-story office and retail building, a one-story retail building, and a parking lot.

Industrious To Open 40,000-Square Foot Coworking Space In South Beach

It will occupy the space previously filled by WeWork from November 2014 until August 2018, when the company was forced to scale back its operations.

New-To-Market Tenants Spur Wynwood Office Demand

Wynwood is becoming Miami’s busiest office submarket as demand for space is far surpassing current supply due to its attractive live-work-play environment, with more than 80% of its recently leased office tenants being new-to-market and a million square feet of office space in the pipeline.

Miami Beach To Seek Development Proposals For 41st Street Surface Parking Lots

Miami Beach Mayor Dan Gelber said seeking letters of intent is a preliminary step, geared to finding out what developers think can be built on the parking lots.

Miami Beach Mayor Announces List Of New Projects – New Cancer Center, 3-Acre Public Park And Push To Renovate Lincoln Road

The new projects are slated to come online this year.

Turnberry Proposes Office/Retail Project Near Aventura Mall

The project, called Two Turnberry, would have 240,000 square feet of offices and 20,000 square feet of retail.

Core Wynwood Development Site Sells For $11.5 Million

The two fully occupied building are currently leased as creative office space spanning 10,939 square feet.

Miami-Dade Plans Massive Redevelopment In Downtown Miami

The purpose of the 10- to 15-year redevelopment is to better use county-owned lands and meet community needs.

Wynwood Annex Sells To New-To-Market Buyer For $44 Million

This transaction underscores a paradigm shift in rates and market fundamentals and sets a new bar for the Miami office market.

Blockchain.com To Open 22,000 SF Miami HQ In Wynwood

The lease deal brings the building to full occupancy.

Cheesecake Factory Inks Lease On Miami Beach’s Lincoln Road

The national restaurant chain is taking Sushi Samba’s former 7K sf space.

Mixed-Use Project With High Street Retail Planned As ‘Alternative To Aventura Mall’

The site was rezoned in June for apartments, a hotel, offices, retail and an assisted living center

Crescent Heights Scores School Board Approval To Buy Downtown Miami Land For Mixed-Use Project

Construction is expected to begin immediately after obtaining entitlements, and the project would take about 38 months to complete from groundbreaking.

Miami Beach Readies Four City-Owned Sites For Sale

Funds from the sales of these properties were considered to fund capital projects such as the 72nd Street Community Complex project in North Miami Beach, a project that includes a 7,500-square-foot library, a 50-meter competition pool and a 25-meter multi-purpose pool, among other amenities, and which had a budget shortfall of $16.1 million, according to the latest estimate.

Multifamily Developments In Pipeline Could Take Years To Finish

In the past year, Miami delivered 7,400 units and had a net absorption of 13,900 units.

Goldman Properties Proposes Office Building In Wynwood As Big Companies Descend On The Arts District

The developer aims to break ground on the project in late 2022 and complete the building by 2024.

Related Group, W5 Group Break Ground On Quarters Wynwood Co-Living Development

The building, which will be located at 33 NW 28th St., will feature shared living spaces and residents will rent bedrooms in shared apartments.

$100 Per Square Foot? Rent For Prime Office Space Puts Miami On Par With New York

Overall, the average listed rental price for office space in Greater Miami now stands at $46.19 per square foot.

New Downtown Miami High-Rise Project Seeks To Bring More Affordable Urban Living

Three towers, between 39 stories and 48 stories, would sit on top of a new public parking garage with 1,350 spaces and retail on the ground floor.

3.4M-Square-Foot Tower Could Rise At Former Miami Arena Site

The project would have three 57-story towers connected by a podium at the base, comprised of 2,195 residential units, 540,000 square feet of offices, 49,999 square feet of retail and 2,457 parking spaces.

Tristar Proposes Pair Of Office Buildings In Wynwood

Both buildings would rise eight stories with a pedestrian paseo between them and have active roof decks.

Incentives Bring New Life To Film Industry In Miami-Dade

After a few starts and stops over the past two years, Miami-Dade’s film industry is coming back to life and reclaiming its reputation of being one of the most desirable shooting destinations in the world.

Offices On The Beach: Billionaires Bankroll Class A Office Space Near Their Homes

It’s a burgeoning trend that could help change the perception of Miami Beach as a place just for fun and sun.

Migration From North Triggering Continuous Economic Growth In Miami

The increasing migration of Northern high-income executives is accelerating the real estate markets and the overall economy in South Florida, while banks are reporting substantial profit gains and are eager to welcome their businesses.

Ex-Google CEO Owns Major Interest In South Beach Class A Office Project In The Works

The building “as presented by the applicant” will be 41,377 square feet in size and include 38,252 square feet of office, 3,2125 square feet of retail, and mechanical parking.

Looking To Lease Office Space In South Florida? Here’s What You Can Expect To Pay

South Florida’s office market showed signs of a full rebound as asking rental rates surpassed pre-pandemic levels.

Cryptocurrency Starts To Make A Splash In Luxury Housing. Will It Trickel To Larger Residential And Commercial Markets?

So far, much of the buzz around cryptocurrency in real estate has been the luxury segment of the for-sale housing market. But a few early adopters in commercial real estate have begun to accept crypto in transactions.

AMAC Acquires 1800 Alton For $32.5M, Showcases Strength In Miami Retail

1800 Alton is ideally positioned in Sunset Harbour, the vibrant neighborhood at the gateway into South Beach, with many high-end residential buildings, retail spaces, and the Sunset Harbour Marina.

Transit-Oriented Wynwood Parcel Sells For $19.5 Million

Still in the planning stages, Fifield looks to develop a mixed-use apartment community on their newly acquired site.

Former Miami Rescue Mission Building Trades In Off-Market Deal, Creating One Of The Largest Contiguous Sites In Wynwood

The building is located adjacent to Soho Studios, a 45,000-square-foot creative event space, on a 68,000-square-foot lot located at 2136 NW 1st Ave, which is also owned by The Faith Group.

CRE’s Growth Forecast For 2022

According to the National Association of Realtors, commercial real estate is expected to strengthen in 2022, especially in industrial and multifamily. Bottom line: CRE’s underlying demand fundamentals should more than mitigate the impact of the slightly higher interest rates in the new year.

Wynwood Plaza Development Set After $50 Million Sale Of Former Rubell Art Museum Site

Designed by architectural firm Gensler, The Wynwood Plaza would bring 12- and 8-story buildings with 509 apartments to the neighborhood, 266,000 square feet of offices, 32,000 square feet of commercial-retail uses, and parking for about 668 vehicles.

CRE Values, Yields Forecasted To Increase Next Year

Values are expected to increase 11%, while yields will average 6%.

Miami Tech And Financial Sectors Spark Economic Gain

The first quarter of 2021 brought Florida a 7% increase in GDP, ranking 15th in the nation in GDP.

What Secondary Asset Classes Will Be Popular With Investors In 2022?

Here are some of the non-mainstream asset classes seeing renewed interest from capital sources, in 2021 and heading into next year.

Black Lion’s South Florida Retail Shopping Spree Continues With $19M South Beach Deal

Black Lion, led by Robert Rivani, paid roughly $995 a square foot for 19,100 square feet of retail.

Miami Positioned As Blockchain City Of The World

Miami is very well positioned to be the blockchain city of the world, experts are saying, as an influx of talented people in the blockchain technology industry are choosing the city to develop their businesses and create a crypto-enthusiastic community.

Recently Renovated Miami Beach Office Building Sells For $26.5M

The developers acquired the building for $10.1 million in 2019.

Looming Tax Break Deadline Is Spurring Last-Minute South Florida Real Estate Deals

Besides the temporary deferral, other advantages include the exclusion of taxable income on new gains on investments held for 10 years or more, and a 10% increase in the investment if the qualified opportunity fund is retained for five years and a 15% increase if the investment is held for seven years.

Sellers Will Take Cryptocurrency For Miami Beach Properties

Cryptocurrencies, including Bitcoin, tend to swing widely in value. But Jared Robins said FTX’s ability to instantly exchange crypto into cash “really de-risks that whole aspect of it.”

THesis Miami Raises $33M From Retail Investors With Plan to Tokenize

Pending approval, retail investors will be able to trade shares in the property, backed by a cryptocurrency issued by NRI after a six-month lockup period.

Miami Board Denies Wynwood Station Mixed-Use Project

The board voted unanimously Nov. 17 to deny the project, after voicing numerous concerns including the massing of the building, location of a trash chute, location of elevators, design of the parking levels and ramps, the width of a covered walkway, the size of a courtyard and more.

Beacon Council Targeted Jobs Initiative Paid Big Dividends

rom 2012 to 2019 Miami-Dade added 202,970 overall jobs. In 2018 and 2019, jobs added in all sectors totaled 33,243, including 6,556 in the targeted industries.

Five Class A Office Projects In The Development Pipeline For Miami Beach

Intent on diversifying its economy beyond tourism and nightlife, officials have heavily incentivized the construction of Class A office buildings in Miami Beach.

Miami’s Art Basel Returns With Real Estate Fanfare

For real estate executives, Art Basel is as much about play as it is about work.

Commercial Real Estate Trends And The Call For Creativity

The ripple effect of the pandemic’s impact on the commercial real estate market is going to have a lasting effect on several market sectors.

A Skatepark Is The Centerpiece To This Miami Developer’s New Mixed-Use Concept

The concept, dubbed SkateBird, will serve as a skating arena, shopping hub, event center and food hall.

Renter Churn: Which Cities Are Seeing The Most?

Of renters looking to move, an average of 40 percent were looking to move out of the metro where they resided in the third quarter of 2021, according to a report from Apartment List, based on searches on their platform.

‘Lowest Vacancies In Years’ Drive Up Prices For Multifamily Investors

But it isn’t just Class C apartment buildings — classified as multifamily structures more than 30 years old and in fair-to-poor condition — that are rising in value.

Wynwood Just Got A Little More Vibrant

The long-awaited exterior garage cladding, which depicts a vibrant mural, has been fully installed just in time for Art Basel next month.

The Pandemic Has Made Healthcare Real Estate More Desirable

Investors are now looking at assets that are both resilient during a recession and during a pandemic, and healthcare properties have become the perfect hedge against both.

Large Mixed-Use Project Makes Big Changes To Win OK In Wynwood

The development team behind one of the largest mixed-use residential and office projects to rise in Wynwood continues to work with the City of Miami Planning Department staff and is confident of final approval.

Retail Space Is Hard To Find In South Florida Thanks To Migrating Restaurants

The scarcity of space has had an effect in Miami-Dade, where the asking leasing rates increased 12.5% to $38.98 per square foot this third quarter, from $35.54 a square foot year-over-year.