Tricera Capital, the Miami-based commercial real estate firm led by Ben Mandell, and LNDMRK Development completed several leases totaling almost 14,000 square feet at major mixed-use development Society Wynwood.

Newly signed tenants include Starbucks, Chama De Fogo Brazilian Steakhouse and Nacho Daddy.

Starbucks will occupy 2,615 square feet of retail space at Society Wynwood. The Seattle-based coffee giant has a strong presence throughout South Florida, including at Tricera’s Shops at the Press in West Palm Beach.

Chama De Fogo leased 5,522 square feet at Society Wynwood for its second Miami location. The Brazilian steakhouse concept has become extremely popular over the years, and Chama De Fogo prides itself on its authentic gaucho barbecue and high-quality meats. The Society Wynwood location will feature a casual dining restaurant, butcher shop and delicatessen.

The Las Vegas-born Nacho Daddy opened its first store in 2010. Today, the modern Mexican-style restaurant has grown tremendously with six locations nationwide serving gourmet nachos and more. The 5,434-square-foot lease in Society Wynwood will be the restaurant’s seventh and the only one in Florida.

“We are excited to be part of the continued growth of Wynwood and bring compelling tenants such as Starbucks, Chama De Fogo and Nacho Daddy to this project,” said Tricera President | Head of Leasing Dustin Ballard. “Society Wynwood will add to the elevated ecosystem of restaurants, retail and living experiences the eclectic art district offers its residents and guests.”

Irma Figueroa, Andrew Rosenberg and Max Gelband with Comras Company are Tricera and LNDMRK’s leasing representatives at Society Wynwood.

Elizabeth Higgins, Marty Arrivo and Aracibo Quintana of Acre represented Starbucks in its lease. Elizabeth Hazan of Byblos Hospitality Holdings was a consultant for Chama De Fogo. Jenny Geffen and Dave Preston with Colliers represented Nacho Daddy.

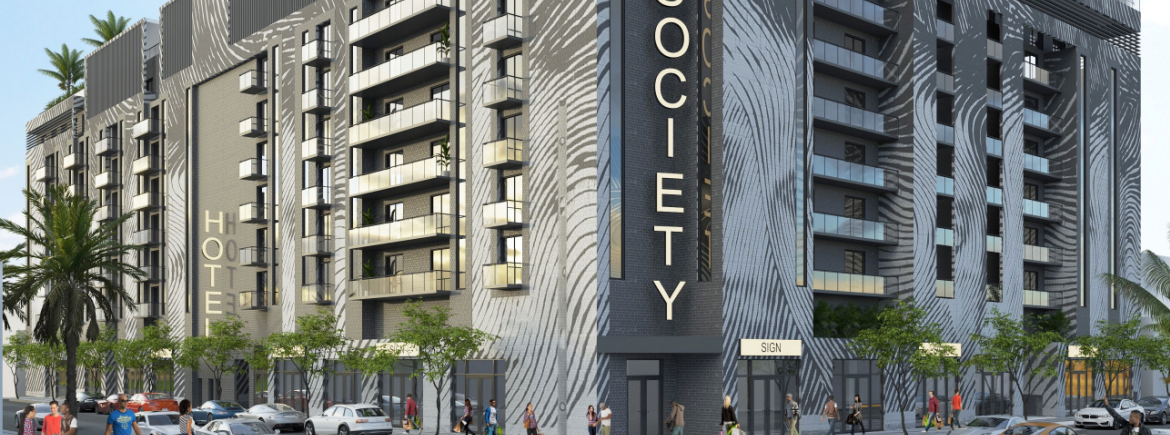

In partnership with Society Wynwood developers PMG and Greybrook Realty Partners, Tricera and LNDMRK are forward-purchasing over 32,000 square feet of ground floor retail at the project. The 2431 NW Second Ave. development is conveniently located in the center of the Wynwood Art District, within walking distance of many new developments and retail shops. Along with the ground-floor retail, Society Wynwood has almost 300 modern residential units and a private parking garage, making it the area’s premier new development.